Public Service Superannuation Fund: Transforming Public Service Retirement Benefits

Commencing on 1st January 2021 as per Legal Notice No.156 published in the Kenya Gazette Supplement No. 146 of 12th August 2020, the Public Service Superannuation Scheme (PSSS) is a Defined Contribution (DC) retirement benefits scheme for civil servants, teachers employed by the Teachers Service Commission and the Disciplined Services Personnel. The scheme was established under the Public Service Superannuation Scheme Act Cap189A as part of the Government’s reforms initiatives in the Pensions Sector. With a mission to collect contributions, optimally invest and pay benefits to scheme members and their beneficiaries sustainably through sound financial, good governance and risk management policies in pension fund administration, the PSSF aims to be a trusted retirement benefits provider as Corporate Watch magazine’s Swao Mururi narrates.

When Dr. Jonah Aiyabei joined the Public Service Superannuation Fund (PSSF) on November 1st, 2023 as its new Chief Executive Officer (CEO), his mission was very clear- to provide strategic leadership at PSSF to see the fund grow into one of the largest pension schemes in Kenya, and ultimately offer decent retirement benefits to members.

Dr. Aiyabei had just left Kenya Pipeline Company (KPC) having served as the pioneer director of the Morendat Institute of Oil and Gas (MIOG) between 2016 and 2023.

Dr. Aiyabei holds a Ph.D. in Business Administration and a Master’s in Business Administration (MBA). He has also completed various leadership programs, including Executive Leadership training at the Wharton School, University of Pennsylvania. He is a fellow of the Institute of Certified Investment and Financial Analysts (ICIFA) and a former chairman of the Institute.

But as the new CEO, was he prepared and ready to lead PSSF to greater strides bearing in mind that he was transitioning from the oil and gas sector?

“The shock could have been moving from the pension industry to the training sector in the oil and gas industry. Remember, I had served for many years as the Trust Secretary and Trustee for the Kenya Pipeline Company Pension Scheme and therefore, I was basically coming back into a more familiar territory,” said Dr. Aiyabei during an interview with Corporate Watch Magazine at his ornate office situated on the 1st floor of Central Bank of Kenya Pension Towers building off Harambee Avenue in Nairobi.

“I found PSSF at its nascent stage and had to build on the foundation set by my predecessors to establish institutional structures, skilling and retooling of staff,” Dr. Aiyabei said, adding that through the hard work of PSSF’s staff members and the Board of Trustees, the organisation managed to surmount its fair share of challenges.

“I have enjoyed a harmonious working relationship with the men and women who constitute the Board of Trustees led by the Chairman Hon. Wycliffe Wangamati,” Dr. Aiyabei said, lauding the support and commitment from The National Treasury.

To date, the scheme’s fund value has grown to Ksh190 billion in three years of its operations. The scheme covers Civil Servants, teachers employed by the Teachers Service Commission and Disciplined Services (National Police Service, Prisons Service and National Youth Service).

Membership to the contributory scheme comprises of employees serving on permanent and pensionable terms of service and aged below 45 years as at 1st January 2021, new employees who joined the service on or after 1st January 2021 on permanent and pensionable terms of service, employees aged 45 years and above as at 1st January, 2021 who opted to join the new contributory Scheme and employees whose services were transferred to the county governments.

Dr. Ayaibei added that the Scheme is actively engaging members across the country as part of its ongoing education initiatives to enhance awareness and ensure members fully understand their benefits and retirement options.

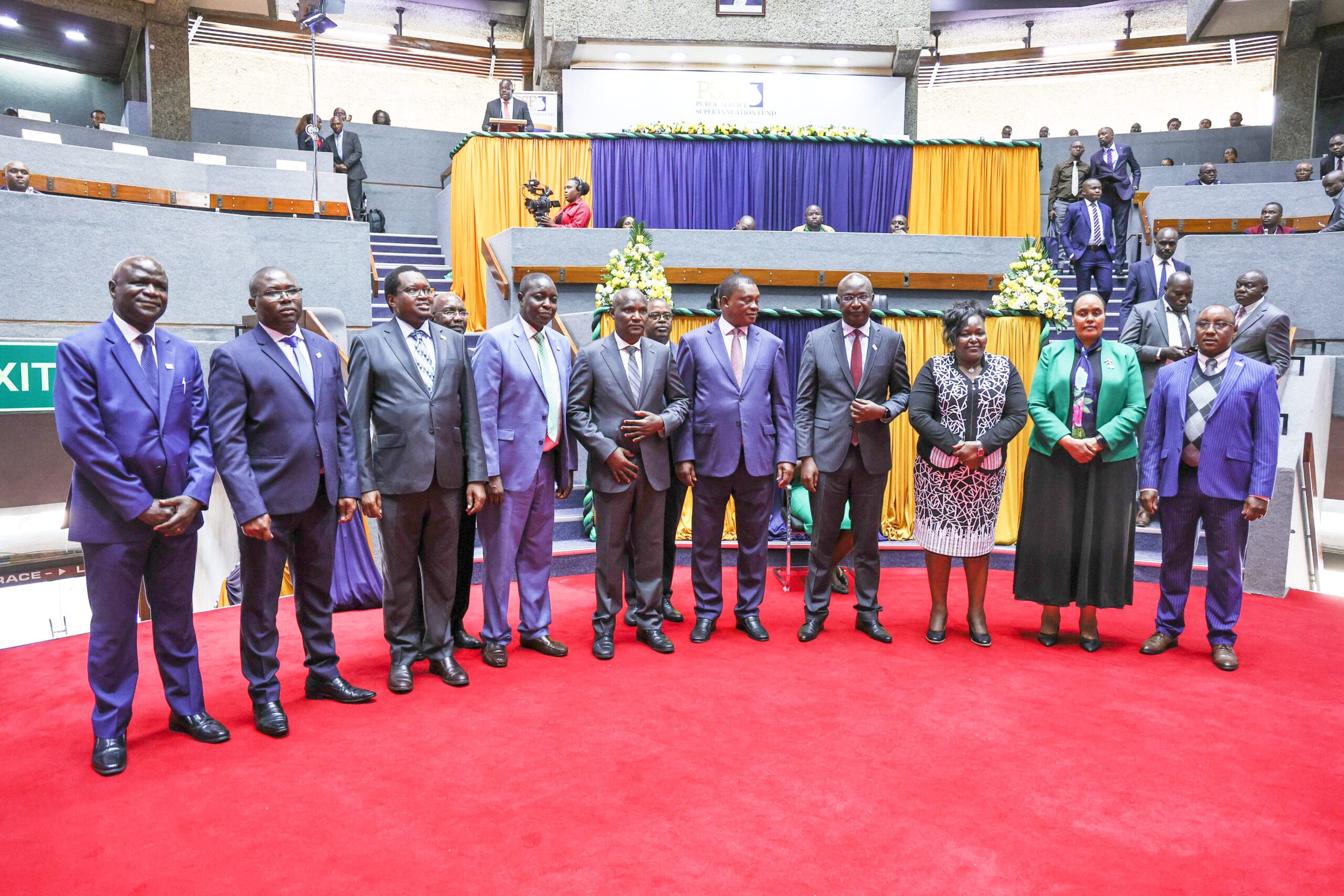

“We have also successfully held two Annual General Meetings during this period, providing the Board of Trustees with an opportunity to report on the Scheme’s performance in line with regulatory requirements. The AGM for the 2022-2023 period was successfully conducted, followed by the recently held AGM for the 2023-2024 period,” he stated.

He added that the PSSF Strategic Plan 2023-2027, launched in 2024, positions the Fund to maximize return on investment of the members’ funds to enhance retirement benefits. To achieve this, Dr. Aiyabei said, all efforts will focus on ensuring the Fund’s sustainability and enhanced replacement income, efficient fund administration and institutional capacity development, while contributing to social security to members and their beneficiaries.

On investments, Dr. Aiyabei explained that the Scheme receives funds, invests them to generate returns, and allocates investment income to members. This approach ensures the long-term sustainability of the Scheme and guarantees financial security for its members in their retirement years.

Under the scheme, members contribute 7.5 percent of their basic salaries, with the Government contributing 15 percent of the member’s basic pay.

This is a shift from the past when the Government operated a non-contributory pension scheme since independence, which was financed fully by the Exchequer. The model, however, proved unsustainable as the full burden of the pension bill was placed on taxpayers. The establishment of the PSSF, Dr. Aiyabei says, was part of the reforms in the public service pensions sector.

The fund attributes its performance to its investments, driven by a robust Investment Policy Statement (IPS) which outlines asset allocation strategies aimed at balancing risk and return, ensuring capital preservation while maximizing income.

PSSF is leveraging technology to deliver services efficiently and enhance member experience. Members now have access to real-time updates on their contributions and statements through an online portal and a USSD code, making it easier to track their retirement savings.

Additionally, the Scheme is continuously exploring digital innovations to streamline service delivery, improve accessibility, and enhance financial literacy among members. The fund’s total membership currently stands at 443,054, reflecting its growing reach and impact.